Overview

- Fairfax Financial Holdings Ltd. (TSX:FFH; Fairfax) has built a very strong and diverse competitive position through organic growth and strategic acquisitions leveraging market opportunities, while benefiting from favorable re/insurance pricing.

- We expect Fairfax’s capitalization to further strengthen and remain redundant at an ‘A’ confidence level through 2024, from improving earnings and capital management. Fairfax’s financial leverage and coverage metrics improved in 2021, and we expect the trend to continue prospectively.

- We raised our ratings on Fairfax’s core re/insurance subsidiaries to ‘A’ from ‘A-‘. The stable outlook reflects Fairfax’s very strong competitive position supported by operating earnings expansion, strengthening capitalization, and moderating financial leverage.

Rating Action

On May 27, 2022, S&P Global Ratings raised its long-term issuer credit rating on Fairfax Financial Holdings Ltd. to ‘BBB’ from ‘BBB-‘. We also raised our long-term issuer credit and financial strength ratings on Fairfax’s core re/insurance subsidiaries to ‘A’ from ‘A-‘. The outlook on all entities is stable.

Rationale

The upgrade reflects our view that Fairfax’s credit profile benefits from a very strong competitive position based on large and diversified re/insurance operations that are well established in their respective markets. In 2021, Fairfax’s gross premiums written (GPW) increased to $23.8 billion (excluding run-off and life) benefiting from favorable re/insurance pricing, supported by $19.3 billion of shareholders’ equity (including insurance non-controlling interests). Based on 2021 premiums, Fairfax had the second largest Lloyd’s syndicate, ranked the fourth largest U.S. excess and surplus writer, the fourth largest Canadian commercial lines writer, and was one of the top 20 global reinsurers. In the first quarter of 2022, GPW rose 21.9% year-over-year, building on last year’s strong price increases in most major business segments and new business writings. We expect the premium growth to be robust, around 15% in 2022, and 10% in 2023-2024.

In 2021, Fairfax generated a strong combined ratio of 96.0% (including corporate expenses and excluding run-off; 95.0% as reported), despite $1.15 billion of natural catastrophe losses or 7.2 combined ratio points. Similarly, in the first quarter of 2022, Fairfax produced strong underwriting results with a combined ratio of 93.9% (93.1% as reported) including modest natural catastrophe losses of $130 million or 2.8 combined ratio points, with no significant effects from the Russia-Ukraine conflict. We expect Fairfax’s combined ratio to improve to 93%-96% in 2022-2024, helped by re/insurance rate increases, including a natural catastrophe load of about five points.

We expect Fairfax’s prospective capitalization to improve such that it is sustainably redundant at an ‘A’ confidence level through 2024. Fairfax is actively optimizing its capital structure to maximize shareholders’ value while supporting the financial strength of its holding company and re/insurance subsidiaries. Fairfax repurchased $1.19 billion of its subordinate voting shares in 2021, which was mostly funded by a sale of 9.99% or $900 million minority stake in Odyssey to two Canadian pension funds (CPPIB and OMERS) in December 2021. In addition, in August 2021, Fairfax sold 13.9% of Brit to OMERS for $375 million and sold its 60% joint venture interest in Riverstone Barbados to CVC Capital Partners for $462 million in cash and $200 million in non-voting shares of CVC’s Riverstone Barbados. These transactions helped improve the company’s risk-adjusted capitalization and reduced financial leverage. Fairfax follows a total return investment strategy with a large allocation to risky assets. The company’s consolidated investment portfolio of $53.02 billion as of Dec. 31, 2021, included 39.2% of risky investments ($53.42 billion and 41.2%, respectively, as of March 31, 2021), which is at the higher end of its peers. An active approach to investments focused on generating long-term gains leads to uneven returns. This is reflected in the sizeable net gains on investments of $3.45 billion in 2021. The company continues to adjust its investment mix to take advantage of a more opportune market during rising rates, and deploy its cash and short-term investments of $22.8 billion as of Dec. 31, 2021 ($14.2 billion as of March 31, 2022). Fairfax’s efforts to monetize some assets could also add to earnings and provide capital relief. Given its short duration of 1.4 years as March 31, 2022, value oriented-equity portfolio, and a large cash pile, Fairfax’s investments were less affected by realized and unrealized losses ($214 million or 1.0% as of year-end 2021 shareholders’ equity) in the first quarter of 2022 relative to peers. Fairfax’s investment earnings could expand as the company repositions its investment portfolio, although the redeployment is subject to the economy and financial markets.

Fairfax has refinanced a few issuances with lower coupon debt. The company has also fully repaid its $700 million credit facility balance in 2021, and raised funds through several sales. As a result, the consolidated financial leverage significantly improved to 34.3% in 2021, from 42.4% in 2020, and its deconsolidated leverage (excluding nonrecourse debt held at non-insurance operations) also materially improved to 30.9% from 37.7%. In addition, the expanding market presence of Fairfax’s re/insurance operations, disciplined underwriting, and re/insurance rate increases are likely to drive gains in underwriting earnings, along with an anticipated increase in investment income, and higher non-insurance profits benefitting from the reopening economies over the next three years. We expect financial leverage (excluding nonrecourse debt held at non-insurance operations) to remain around 30% or lower (consolidated ratio below 35%) in 2022-2024, and fixed-charge coverage to be at least 4x.

Outlook

The stable outlook reflects Fairfax’s very strong competitive position reinforced by operating earnings expansion, improving capitalization supporting robust top line growth, and a moderating financial leverage profile.

Downside scenario

Contrary to our expectations, we could lower our ratings by one notch within the next 24 months if:

- The anticipated improvement in capitalization doesn’t materialize with a capital adequacy that isn’t redundant at an ‘A’ confidence level on a sustained basis;

- Financial leverage (excluding nonrecourse debt held at non-insurance operations) is above 35% (consolidated ratio above 40%);

- Fixed-charge coverage is below 4x on a sustained basis; or

- The volatility profile changes because of increased risk tolerance or shifts in investment or business mix, resulting in higher risk exposure.

Upside scenario

We could raise our ratings on Fairfax by one notch within the next 24 months if:

- Capitalization improves sustainably to a level that is materially redundant at an ‘A’ confidence level;

- Financial leverage (excluding nonrecourse debt held at non-insurance operations) improves to below 30% (consolidated ratio less than 35%);

- The company’s fixed-charge coverage ratio is a least 5x; and

- Fairfax’s diverse insurance operations continue to leverage market opportunities, with sustained operating performance in line with higher-rated peers.

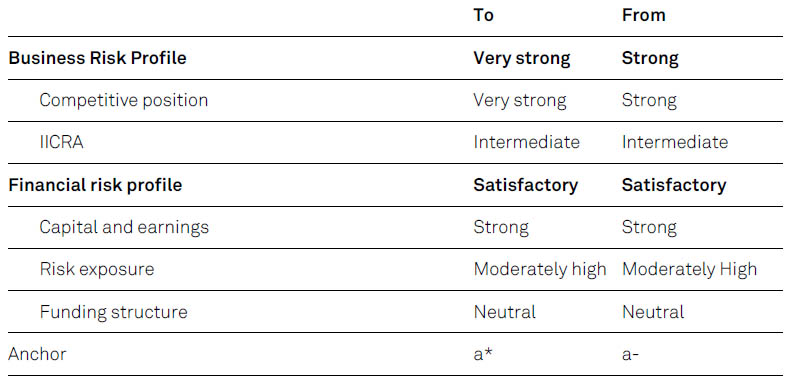

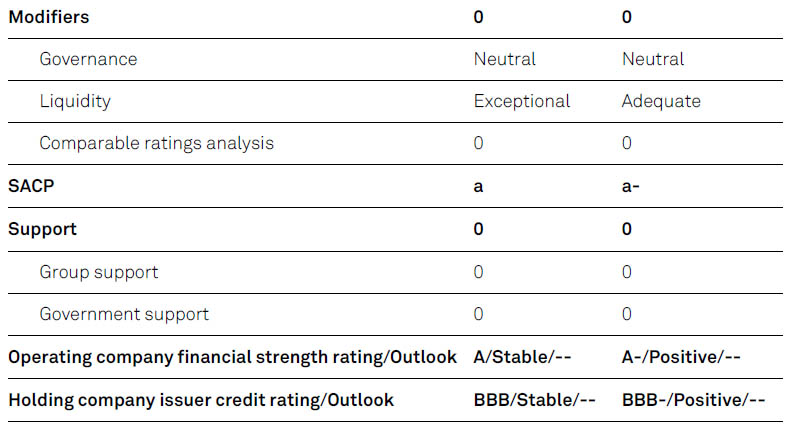

Ratings Score Snapshot

IICRA–Insurance Industry and Country Risk Assessment. *The combination of a very strong business risk profile and a satisfactory financial risk profile results in a split anchor of ‘a+/a’. We select the lower of the two to reflect the still strengthening capital adequacy, which we expect to remain redundant at an ‘A’ confidence level.

ESG credit indicators: E-3, S-2, G-2

Related Criteria

- General Criteria: Environmental, Social, And Governance Principles In Credit Ratings, Oct. 10, 2021

- General Criteria: Hybrid Capital: Methodology And Assumptions, July 1, 2019

- Criteria | Insurance | General: Insurers Rating Methodology, July 1, 2019

- General Criteria: Group Rating Methodology, July 1, 2019

- General Criteria: Guarantee Criteria, Oct. 21, 2016

- General Criteria: Principles Of Credit Ratings, Feb. 16, 2011

- Criteria | Insurance | General: Refined Methodology And Assumptions For Analyzing Insurer Capital Adequacy Using The Risk-Based Insurance Capital Model, June 7, 2010 Related Research

- Russia-Ukraine Conflict Adds To A Bumpy Start To 2022 For Global Reinsurers, March 31, 2022

- Fairfax Financial Holdings Ltd. Outlook Revised To Positive On Improving Earnings And Capitalization; Ratings Affirmed, May 25, 2021

Ratings List

Certain terms used in this report, particularly certain adjectives used to express our view on rating relevant factors, have specific meanings ascribed to them in our criteria, and should therefore be read in conjunction with such

criteria. Please see Ratings Criteria at www.standardandpoors.com for further information. Complete ratings

information is available to subscribers of RatingsDirect at www.capitaliq.com. All ratings affected by this rating

action can be found on S&P Global Ratings’ public website at www.standardandpoors.com. Use the Ratings search

box located in the left column.